Online Payment

Start Taking Card Payments Online On Your Web Site Through Our Hosted Or Integrated Payment Services.

Benefits

- Access to Revolution, the leading administration and reporting platform.

- Transaction management information and consumer intelligence reporting via the Revolution platform.

- Flexible integration options as well as virtual terminal capability.

- Solutions hosted on PCI DSS Level 1 compliant payments network.

- Branding options for payment pages and the Revolution portal.

- Schedule Pay enables recurring payment capability.

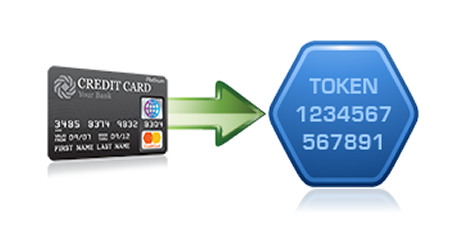

- Tokenisation option reduces the level of PCI DSS compliance obligations.

Merchants can integrate in a number of ways

Hosted Form

With a hosted form solution a consumer goes through the purchasing process on a merchant’s site, when they reach the payment stage they are passed to SmartPay via HTTPS. Along with the request passing them to SmartPay important information including their name, address and the transaction value is also passed over. This information is encrypted and is then used to dynamically populate a payments page. The payments page can be designed with the merchants branding, controlled via the Revolution portal.

The webpage will give the consumer the opportunity to input their credit or debit card information and submit the transaction for processing. When the payment has been authorised the merchant has the option of having a specific script called and forwarding the consumer to a “Thank you” page.

This method ensures the merchant can accept credit and debit card payments quickly and easily with very little integration but also without having to handle or store credit card information and consequently going through a PCI DSS compliance process.

XML API

The XML API option is for those merchants who want to take advantage of greater flexibility and are happy to assume additional responsibility when processing consumer payments. The merchant would take the credit or debit card details of the consumer securely, using SSL encryption from within their website. The transaction is then submitted to the merchant’s website which securely sends an XML request containing the card holder and credit card information to SmartPay.

The merchant can have the option of using the credit or debit card information once only, storing it within their system or taking advantage of the SmartPay tokenisation capability (which is better specified below). The merchant must go through a PCI DSS self-certified assessment if they are taking and storing credit card information. Such assessments are usually insisted on by the merchant’s acquirer or alternatively SmartPay can provide this as an additional service.

LinkToPay

LinkToPay is the first service launched as part of its PayAnyway product suite, created to provide innovative and convenient ways for customers to pay and merchants to get paid. LinkToPay enables you to send a payment request to a customer by email or by text message with a link for them to pay you securely via a web page. The secure web page is responsive allowing payments to be made simply and easily through mobile devices as well as computers.

LinkToPay also generates a short URL as well as a QR code enabling customers to incorporate alternative options to pay in both printed and posted invoices.LinkToPay helps you get paid faster and makes it more convenient for your customers and improving your cashflow.

How does LinkToPay work?

- Merchants can use the web based tool to create a LinkToPay request, alternatively there is also an API option to integrate the feature into your existing CRM or billing system.

- The merchant chooses how the request should be made to the customer, by mail, by text message or both.

- The system will also create a short URL and QR code that can be sent to the customer to initiate payment.

- This can be for a one-off charge or a recurring payment (subscription) from a customer.

- The merchant simply supplies the contact information of the customer including name, address, email address and mobile number (if a text message request is required) along with information relating to the payment request such as order reference, description, amount and whether the payment is one-off or recurring.

Value Added Services

Tokenisation